GE_Gravity Theory, Logic, Testing, and Comparison

Tom Zylkin, Vadim Kudlay

Source:vignettes/about.Rmd

about.RmdThis is a compiled RMD file describing a GEGravity in

more depth. For parameterizations and basic description, see the

documentation i.e. help(ge_gravity). This is more of an

extension to the formal documentation to keep the help

command from being overbloated.

This overarching file contains all of the contents of

theory.Rmd, example.Rmd,

logic.Rmd, and compare.Rmd, almost in that

order. To see the smaller version, please check out

ge_gravity_rmd

Background

As a typical application, consider the following model for international trade flows: \[X_{ij} =\frac{A_{i}w_{i}^{-\theta}\tau_{ij}^{-\theta}}{\sum_{k}A_{k}w_{k}^{-\theta}\tau_{kj}^{-\theta}}E_{j}\]

\(X_{ij}\) are international trade flows. \(i\) and \(j\) are indices for origin and destination. \(E_{j} \equiv \sum_{i}X_{ij}\) is total expenditure (also equal to the sum of the value of shipments across all origins). \(A_{i}\) is a measure of the level of technology in each origin \(i\), \(w_{i}\) is the production cost, and \(\tau_{ij} > 1\) is an iceberg trade cost. The model assumes that goods received from different origins are imperfectly substitutable and that the degree of substitutability is governed by \(\theta > 0\), which serves as a trade elasticity. Labor, \(L_{i}\), is assumed to be the only factor of production. Trade imbalances, treated as exogenously given, are accounted for as an additive component of expenditure. Thus, we can also write national expenditure as the sum of labor income and the national trade deficit/surplus: \(E_{j} = w_{j}L_{j} + D_{j}\).

To obtain the effects of changes in trade policies on trade (i.e., holding all wages fixed), a standard approach is to estimate using structural gravity. For example, if we have a panel of trading countries and we want to know the “average partial effect” of FTAs on trade, we can estimate the following “three-way” gravity regression:

\[X_{ijt} =\exp\left[\ln\alpha_{it}+\ln\alpha_{jt}+\ln\alpha_{ij}+\beta\times FTA_{ijt}\right]+e_{ijt},\]

As discussed in Yotov, Piermartini, Monteiro, & Larch (2016), the estimated \(\beta\) from this specification tells us how much trade would increase on average between any pair of countries that sign an FTA if we hold fixed all the endogenous variables in the model. Or, put in more structural terms, it tells us the direct trade impact of the reduction in trade barriers associated with an FTA: \(\beta=-\theta\Delta\ln\tau_{ijt}\).

However, often the real goal is to compute changes in real wages, welfare, and/or trade volumes as a result of a change in trade frictions. In general equilibrium, the value of a country’s shipments across all destinations must add up to its labor income (\(Y_{i} \equiv w_{i}L_{i} = \sum_{j}X_{ij}.\)) In other words, we must have that

\[w_{i}L_{i} =\sum_{j} \frac{A_{i}w_{i}^{-\theta}\tau_{ij}^{-\theta}} {\sum_{k}A_{k}w_{k}^{-\theta}\tau_{kj}^{-\theta}} \left(w_{j}L_{j}+D_{j}\right) \quad \forall i.\]

This equation pins down each country’s wages (subject to a normalization) as a function of how easily it can sell to markets with high levels of demand. Similarly, notice that we can express the effective price level in each country, \(P_{j} \equiv \left[\sum_{k}A_{k}w_{k}^{-\theta}\tau_{kj}^{-\theta}\right]^{-1/\theta}\), as a function of how easily a country can buy from producers with high technology levels and low production costs. These linkages are both intuitive and general; they can be found in many different trade models typically used for GE analysis.

A useful point about the system of equations in wages is that it can be solved in “changes” (as opposed to solving it in levels). Adopting the notation of Dekle, Eaton, & Kortum (2007), let a “hat” over a variable denote the change in that variable resulting from a policy change (e.g., \(\widehat{w}_{i}\equiv w_{i}^{\prime}/w_{i}\) gives the change in \(i\)’s wage level.) Noting that \(\widehat{\tau}_{ij}^{-\theta}=e^{\beta\times FTA_{ij}}\), the “equilibrium in changes” version of wages can be written as:

\[Y_{i}\widehat{w}_{i} = \widehat{w}_{i}^{-\theta} \sum_{j}\frac{\pi_{ij}\cdot e^{\beta \times FTA_{ij}}} {\widehat{P}_{j}^{-\theta}} \cdot\left(Y_{j}\widehat{w}_{j} + D_{j}\right) \quad\forall i,\]

where \(\pi_{ij}\equiv X_{ij}/E_{j}\) is a bilateral trade share and \(\widehat{P}_{j}\equiv\left[\sum_{k}\pi_{kj}\widehat{w}_{k}^{-\theta}e^{\beta\times FTA_{kj}}\right]^{-1/\theta}\) describes the change in price levels in each country. Notice this equation can be solved without knowledge of technology levels, endowments, initial trade frictions, or initial wages. All that is needed are trade volumes, national output and expenditure levels, and a value for the trade elasticity \(\theta\).

Once changes in wages are known, GE changes in welfare, real wages, and trade volumes are given respectively by: \[ \textbf{GE Welfare Impact}:\quad \widehat{W}_{i}=\widehat{E}_{i}/\widehat{P}_{i}\\ \\ \textbf{GE Real Wage Impact}:\quad \widehat{rw}_{ij}=\widehat{w}_{i}/\widehat{P}_{i},\\ \textbf{GE Trade Impact}:\quad \widehat{X}_{ij}=\frac{\widehat{w}_{i}^{-\theta}e^{\beta\times FTA_{ij}}}{\widehat{P}_{j}^{-\theta}}\cdot\widehat{E}_{j} \] where the change in national expenditure, \(\widehat{E}_{i}\), is given by \((Y_{i}\widehat{w}_{i} + D_{i}) / E_{i}\). Because trade volumes are nominal quantities, there is one normalization needed. For this, the algorithm assumes that total world output is the same across both the baseline and the counterfactual (i.e., \(\sum_{i}Y_{i}\widehat{w}_{i} = \sum_{i}Y_{i}\).) The precise method used to solve the model is described further below.

Algorithm

While there are several ways to solve for counterfactuals in the above model, the simplest approach is arguably a fixed point algorithm that repeatedly iterates on the equilibrium conditions of the model. There are numerous ways to implement such an algorithm, but the approach used in Baier, Yotov, & Zylkin (2019) is especially simple to program. We first initialize \(\widehat{w}_{i}=\widehat{P}_{i}^{-\theta}=1\) \(\forall i\) and \(E_{i}^{\prime}=E_{i}\)\(\forall i\). The iteration loop then requires only 4 steps:

Update \(\widehat{w}_{i}\) \(\forall\) \(i\) one time using \[\widehat{w}_{i} = \left[Y_{i}^{-1}\sum_{j}\frac{\pi_{ij}\cdot e^{\beta\times FTA_{ij}}}{\widehat{P}_{j}^{-\theta}}\cdot E_{j}^{\prime}\right]^{\frac{1}{1+\theta}}\quad\forall i.\]

Normalize all wages so that world output stays fixed: \(\sum_{i}Y_{i}\widehat{w}_{i}=\sum_{i}Y_{i}\).

Update \(\widehat{P}_{j}^{-\theta}=\left[\sum_{k}\pi_{kj}\widehat{w}_{k}^{-\theta}e^{b\times FTA_{kj}}\right]\) \(\forall\) \(j\).

Update \(E_{j}^{\prime}=Y_{j}\widehat{w}_{j}+D_{j}\) \(\forall\) \(j\).

- (Repeat steps 1-4 until convergence.)

This algorithm is very similar to one previously made available by Head & Mayer (2014), but takes a slightly more streamlined approach to updating wages in step 1. It should generally be very fast because it does not involve using a nonlinear solver.

Example

For an example, the package comes with example data

TradeData0014. The data set consists of a panel of 44

countries trading with one another over the years 2000-2014. The trade

data uses aggregated trade flows based on WIOD and information on

FTAs is from the NSF-Kellogg

database maintained by Scott Baier and Jeff Bergstrand. To find out

more about the trade data, see Timmer,

Dietzenbacher, Los, Stehrer, and de Vries (2015).

data(TradeData0014) # loads data included with package

head(TradeData0014)

#> exporter importer expcode impcode year trade eu_enlargement other_fta

#> 1 AUS AUS 1 1 2000 7.047775e+05 0 1

#> 2 AUS AUS 1 1 2005 1.334877e+06 0 1

#> 3 AUS AUS 1 1 2010 2.210350e+06 0 1

#> 4 AUS AUS 1 1 2014 2.436575e+06 0 1

#> 5 AUS AUT 1 2 2000 6.195446e+01 0 0

#> 6 AUS AUT 1 2 2005 1.407591e+02 0 0

#> FTA

#> 1 1

#> 2 1

#> 3 1

#> 4 1

#> 5 0

#> 6 0Suppose the researcher wishes to use this data set to quantify general equilibrium trade and welfare effects of the EU enlargements that took place between 2000-2014. To first obtain the partial effects of these enlargements on trade flows, a PPML (Poisson pseudo-maximum likelihood) gravity specification may be used. Specifically, to obtain the “partial” estimates of the effects of EU enlargements on trade, we can use the following three-way gravity specification:

\[X_{ijt} = \exp\bigg[\ln(\alpha_{it}) + \ln(\alpha_{jt}) + \ln(\alpha_{ij}) + \beta \cdot FTA_{ijt}\bigg] + e_{ijt}\]

The Stata equivalent of this package uses the ppmlhdfe command

created by Correia, Guimarães, & Zylkin (2019) to achieve this. In

our example, we will use the ‘alpaca’ library by

Amrei Stammann to do the same via the feglm (Fixed-Effect

Generalized Linear Model) function.

library(alpaca) # Needed for partial coefficients

# Generate foreign trade subset

f_trade <- TradeData0014[TradeData0014$exporter != TradeData0014$importer,]

# classify FEs for components to be absorbed (finding variable interactions)

f_trade$exp_year <- interaction(f_trade$expcode, f_trade$year)

f_trade$imp_year <- interaction(f_trade$impcode, f_trade$year)

f_trade$pair <- interaction(f_trade$impcode, f_trade$expcode)

# Fit generalized linear model based on specifications

partials <- feglm(

formula = trade ~ eu_enlargement + other_fta | exp_year + imp_year + pair,

data = f_trade,

family = poisson()

)$coefficient # We just need the coefficients for computation

print(round(partials, 3))

#> eu_enlargement other_fta

#> 0.224 -0.037In addition to estimating the effects of EU enlargements on new EU

pairs, this example also controls for any other FTAs signed during the

period. Each of these variables is coded as a dummy variable that

becomes 1 when the agreement goes into effect for a given pair. The

estimated coefficient for eu_enlargements is 0.224,

implying that the expansion of the EU had an average partial effect of

\(e^{0.224} − 1 = 25.1\%\) on trade

between new EU members and existing members. With clustered standard

errors, this estimate is statistically significant at the \(p < .01\) significance level.

Before proceeding, some further pre-processing is needed. Specifically, we need to supply the function with the partial effects of joining the EU estimated above for each of the appropriate pairs. To do this, we create a new variable whose value is either the eu_enlargement partial computed above or 0.

For Stata users, the Stata equivalent of this next step is:

sort exporter importer year

by exporter importer: gen new_eu_pair = (eu_enlargement[_N]-eu_enlargement[1])

by exporter importer: gen eu_effect = _b[eu_enlargement] * new_eu_pairIn R, we do the following:

# Sort matrix to make it easier to find imp/exp pairs

t_trade <- TradeData0014[order(

TradeData0014$exporter,

TradeData0014$importer,

TradeData0014$year),

]

t_trade$new_eu_pair <- NA

t_trade$eu_effect <- NA # this creates a new column that will contain partial effect of EU membership for new EU pairs

i <- 1

# Effect of EU entrance on country based on partial, if entry happened

invisible(by(t_trade, list(t_trade$expcode, t_trade$impcode), function(row) {

# Was a new EU pair created within time span?

t_trade[i:(i+nrow(row)-1), "new_eu_pair"] <<- diff(row$eu_enlargement, lag=nrow(row)-1)

i <<- i + nrow(row)

}))

# If added to EU, give it the computed partial eu_enlargement coefficient (0.224) as the effect

t_trade$eu_effect = t_trade$new_eu_pair * partials[1]To finalize the data for the counterfactual, we will use the year 2000 as the baseline year. The data we will feed to the ‘ge_gravity’ command looks like this:

# Data to be finally fed to the function (we base the counterfactual on the year 2000.)

ge_baseline_data <- t_trade[t_trade$year == 2000,] # In example, 1892 Entries, 5676 removed

# head(data) # First 10 rows

ge_baseline_data[sample(1:nrow(ge_baseline_data), 10),] # 10 random rows

#> exporter importer expcode impcode year trade eu_enlargement other_fta

#> 6289 ROU NOR 36 33 2000 70.42168 0 1

#> 2277 ESP TUR 13 42 2000 1660.11632 0 1

#> 6077 PRT ITA 35 24 2000 893.41356 1 0

#> 1873 DEU LVA 11 29 2000 411.83237 0 1

#> 2433 EST ROW 14 37 2000 499.42945 0 1

#> 5509 NLD EST 32 14 2000 45.65391 0 1

#> 7549 TWN SVN 43 40 2000 48.57555 0 0

#> 4345 JPN MLT 25 31 2000 34.98560 0 0

#> 6589 RUS HUN 38 20 2000 1749.76171 0 0

#> 6045 PRT FRA 35 16 2000 2468.06835 1 0

#> FTA new_eu_pair eu_effect

#> 6289 1 1 0.224249

#> 2277 1 0 0.000000

#> 6077 1 0 0.000000

#> 1873 1 1 0.224249

#> 2433 1 0 0.000000

#> 5509 1 1 0.224249

#> 7549 0 0 0.000000

#> 4345 0 0 0.000000

#> 6589 0 0 0.000000

#> 6045 1 0 0.000000Now that we have the data we need, we can run the ‘ge_gravity’ function as follows:

ge_results <- ge_gravity(

exp_id = ge_baseline_data$expcode, # Origin country associated with each observation

imp_id = ge_baseline_data$impcode, # Destination country associated with each observation

flows = ge_baseline_data$trade, # Observed trade flows in the data for the year being used as the baseline

beta = ge_baseline_data$eu_effect, # “Partial” change in trade, obtained as coefficient from gravity estimation

theta = 4, # Trade elasticity

mult = FALSE, # Assume trade balance is an additive component of national expenditure

data = ge_baseline_data

)

ge_results[sample(1:nrow(ge_results), 10),c(1:2,5:6,12:16)] # 10 random rows

#> exporter importer year trade new_trade welfare real_wage

#> 6429 ROW ITA 2000 49686.811375 49744.775334 0.9999777 0.9999755

#> 485 BEL POL 2000 1205.238414 1474.227573 1.0003657 1.0003587

#> 5629 NLD USA 2000 13529.090121 13517.603220 1.0003121 1.0003057

#> 6893 SVN CHN 2000 12.574958 12.716478 1.0118017 1.0116019

#> 4801 LUX ESP 2000 499.658201 499.641771 1.0002503 1.0002389

#> 1605 CZE CAN 2000 93.113561 91.955797 1.0099827 1.0099972

#> 3573 IDN EST 2000 1.509861 1.460711 0.9999865 0.9999931

#> 2809 FRA TWN 2000 2339.693451 2336.041658 1.0001980 1.0001950

#> 6085 PRT KOR 2000 13.042367 13.041252 1.0000813 1.0000725

#> 3869 IND USA 2000 10715.495243 10715.810196 0.9999966 0.9999961

#> nom_wage price_index

#> 6429 0.9998898 0.9999143

#> 485 1.0002030 0.9998443

#> 5629 1.0001322 0.9998266

#> 6893 0.9970762 0.9856409

#> 4801 1.0001388 0.9998999

#> 1605 1.0030564 0.9931279

#> 3573 0.9998933 0.9999002

#> 2809 1.0002656 1.0000706

#> 6085 0.9998933 0.9998208

#> 3869 0.9999125 0.9999164This assumes a standard trade elasticity value of \(\theta = 4\). The input for \(\beta\) is given by the variable we created

called eu_effect, which is equal to 0.224 for new EU pairs

formed during the period and equal to 0 otherwise. Because of the small

size of the sample, it solves almost instantly. Sample results for the

first 10 rows in the data are shown above for the counterfactual trade

level and the associated changes in welfare, real wages, nomimal wages,

and the local price index. Click on the right arrow to scroll to the

right if they are not all displayed above. For the latter four

variables, the number shown is the result computed for the

exporting country. Unsurprisingly, the new EU members

(Bulgaria, Croatia, Czech Republic, Estonia, Hungary, Latvia, Lithuania,

Malta, Poland, Romania, Slovakia, and Slovenia) realize the largest

welfare gains from their joining the EU, with existing EU countries also

gaining. All countries not included in the agreement experience small

losses due to trade diversion, with the largest losses accruing to

Russia.

We can also change how trade imbalances enter the model. The default

(exibited above with mult = FALSE) is to assume that they enter

expenditure additively (i.e., \(E_j = Y_j +

D_j\)), but one can also change the model so that expenditure is

instead a fixed multiple of income (i.e., let \(E_j = \delta_j Y_j\).) by setting

mult = TRUE. While using multiplicative imbalances instead

of additive balances changes the results slightly, they are still

qualitatively very similar.

An important point about the above exercises is that the initial

partial effect is estimated with some uncertainty. The GE results that

were calculated may paint a misleading picture because they do not take

this uncertainty into account. For this reason, it is considered good

practice to use a bootstrap method to construct confidence intervals for

the GE calculations. This type of procedure can be made easier using

ge_gravity function:

library(data.table) # needed below for bootstrap procedure

# Helper function for shuffling the data with replacement.

# This allows us to shuffle by pair rather than treating each observation as independent.

get_bootdata <- function(data=list(),id) {

uniq_id <- levels(factor(data[,id]))

draw <- sort(sample(uniq_id,replace=TRUE))

draw <- data.table(draw)[,.N,by=draw] # count duplicate pairs in bootstrap sample

colnames(draw)[1] <- id

boot_data <- merge(data,draw,"pair",all.x=FALSE,all.y=FALSE)

boot_index <- rep(row.names(boot_data), boot_data$N) # replicates pairs drawn multiple times after merge

boot_data <- boot_data[matrix(boot_index), ]

boot_data$rep <- (as.numeric(rownames(boot_data)) %% 1)*10+1

return(data.frame(boot_data))

}

# set up for pair bootstrap

set.seed(12345)

bootreps <- 20

TradeData0014[,"pair"] <- interaction(TradeData0014$expcode,TradeData0014$impcode) # This is the ID we will use for resampling.

# Initialize matrices for saving results

x <- TradeData0014[,c("eu_enlargement","other_fta")]

save_partials <- matrix(nrow = bootreps, ncol = ncol(x), dimnames = list(1:bootreps,colnames(x)))

GE_effects <- ge_results[,11:15]

save_GE <- matrix(nrow = bootreps, ncol = ncol(GE_effects), dimnames = list(1:bootreps,colnames(GE_effects)))

# generate bootstrapped gravity estimates using alpaca's feglm function (20 boot reps)

library(alpaca)

for (b in 1:bootreps) {

# This step shuffles the data using the get_bootdata() function defined above

boot_data <- get_bootdata(TradeData0014,"pair")

# These next few steps are exactly the same as the ones we used above to estimate the partial effects

# Generate foreign trade subset

f_trade <- boot_data[boot_data$exporter != boot_data$importer,]

# classify FEs to be absorbed

f_trade$exp_year <- interaction(f_trade$expcode, f_trade$year)

f_trade$imp_year <- interaction(f_trade$impcode, f_trade$year)

f_trade$pair <- interaction(f_trade$impcode, f_trade$expcode)

# Estimate and save partial effects

save_partials[b,] <- feglm(

formula = trade ~ eu_enlargement + other_fta | exp_year + imp_year + pair,

data = f_trade,

family = poisson()

)$coefficient # We just need the coefficients for computation

}

# Obtain bootstrapped GE results based on bootstrapped partial effects

bootstrap_GE_results <- ge_baseline_data

for (b in 1:bootreps) {

# set up baseline data using the estimated partial effect from bootstrap b

boot_ge_data <- ge_baseline_data

boot_ge_data$eu_effect <- save_partials[b,1] * boot_ge_data$new_eu_pair

# run GE_gravity

temp <- ge_gravity(

exp_id = boot_ge_data$expcode, # Origin country associated with each observation

imp_id = boot_ge_data$impcode, # Destination country associated with each observation

flows = boot_ge_data$trade, # Observed trade flows in the data for the year being used as the baseline

beta = boot_ge_data$eu_effect, # “Partial” change in trade, obtained as coefficient from gravity estimation

theta = 4, # Trade elasticity

mult = FALSE, # Assume trade balance is an additive component of national expenditure

data = boot_ge_data

)

# store results

bootstrap_GE_results[,paste0("welf",b)] <- temp[,"welfare"]

bootstrap_GE_results[,paste0("trade",b)] <- temp[,"new_trade"]

}

# get bootstrapped means, SDs, and 95% CIs for partial effects

colMeans(save_partials)

#> eu_enlargement other_fta

#> 0.24045195 -0.03465284

apply(save_partials, 2, sd)

#> eu_enlargement other_fta

#> 0.07753165 0.05578904

apply(save_partials, 2, function(x) quantile(x, probs = .975))

#> eu_enlargement other_fta

#> 0.34988358 0.05572457

apply(save_partials, 2, function(x) quantile(x, probs = .025))

#> eu_enlargement other_fta

#> 0.09867022 -0.11837670

# Get 95% CIs for GE effects

temp <- bootstrap_GE_results[,12:51]

temp <- temp[,order(colnames(temp))]

bootstrap_GE_results[,"lb_welf"] <- apply(temp[,21:40], 1, function(x) quantile(x, probs = .025))

bootstrap_GE_results[,"ub_welf"] <- apply(temp[,21:40], 1, function(x) quantile(x, probs = .975))

bootstrap_GE_results[,"lb_trade"] <- apply(temp[,1:20], 1, function(x) quantile(x, probs = .025))

bootstrap_GE_results[,"ub_trade"] <- apply(temp[,1:20], 1, function(x) quantile(x, probs = .975))

disp_cols <- c("exporter","importer","year","trade","lb_welf","ub_welf","lb_trade","ub_trade")

bootstrap_GE_results[sample(1:nrow(ge_results), 10),disp_cols] # 10 random rows; GE welfare effects are for *exporter*

#> exporter importer year trade lb_welf ub_welf lb_trade

#> 1149 CHE ITA 2000 7.749205e+03 0.9999020 0.9999746 7.752873e+03

#> 4017 IRL ROW 2000 1.639069e+04 1.0000977 1.0003829 1.635859e+04

#> 1557 CYP RUS 2000 1.165478e+01 1.0035637 1.0141773 1.174513e+01

#> 3605 IDN IND 2000 1.156623e+03 0.9999779 0.9999943 1.156626e+03

#> 5197 MEX ITA 2000 3.174025e+02 0.9999928 0.9999981 3.175410e+02

#> 5449 MLT TWN 2000 9.318681e-01 1.0063494 1.0255347 9.040972e-01

#> 1093 CHE CZE 2000 3.707880e+02 0.9999020 0.9999746 3.564777e+02

#> 497 BEL ROW 2000 2.142915e+04 1.0001526 1.0006022 2.138667e+04

#> 7581 USA BGR 2000 1.377859e+02 0.9999968 0.9999992 1.225898e+02

#> 6737 SVK ESP 2000 7.114036e+01 1.0038431 1.0153599 7.871396e+01

#> ub_trade

#> 1149 7.761856e+03

#> 4017 1.638199e+04

#> 1557 1.193969e+01

#> 3605 1.156631e+03

#> 5197 3.178676e+02

#> 5449 9.254744e-01

#> 1093 3.670091e+02

#> 497 2.141733e+04

#> 7581 1.334064e+02

#> 6737 1.012978e+02Note again that the displayed bounds on welfare estimates refer to welfare changes for the exporting country.

Program Execution

Instead of calling the function, let’s assume that we have the variables set as following:

exp_id <- ge_baseline_data$expcode

imp_id <- ge_baseline_data$impcode

flows <- ge_baseline_data$trade

beta <- ge_baseline_data$eu_effect

theta <- 4

mult <- FALSEIn the following, we are going to trace and test the algorithm as if it were being called.

As an assumption: - \(i\) indices are defined for each origin/exporter, and matrices enumerable by them are Nx1 matrices. Sums for all \(i\) are generally defined by colSums - \(j\) indices are defined for each destination/importer, and matrices enumerable by them are 1xN matrices. Sums for all \(j\) are generally defined by rowSums - Column- and Row-wise summations will be done explicitly, and R’s vector math operations will not be assumed to facilitate it.

To be safe and explanatory, we will also define a few functions: -

Typesafe function ts that can verify that our initial

dimensions hold and that no \(\texttt{NA}\) values are introduced. -

Sanity function sanity that will make sure that a

vector/matrix does not change cardinality illogically. -

printHead to show only a tiny subset of data without much

code.

printHead <- function(Vec, rows = 6, cols = 6) {

print(Vec[1:min(rows, nrow(Vec)), 1:min(cols, ncol(Vec))])

}

ts <- function(Vec, Val, line = "?") {

if (dim(Vec)[1] != dim(Val)[1] && dim(Vec)[2] != dim(Val)[2]) {

warning(paste(" > Assigned vector has improper dimensions on line", line, "\n"))

message("Assigning value: \n")

printHead(Val)

message("To Value: \n")

printHead(Vec)

if (readline() == "q") return()

}

if (anyNA(Val)) {

warning(paste(" > Assigned vector has NAs on line", line, "\n"))

printHead(Val)

if (readline() == "q") return()

}

return(Val)

}

sanity <- function(name, Vec, dstr) {

message(" > Sanity Check: ")

for (i in 1:length(Vec))

message(" - dim(", name[i], ") = ",

dim(Vec[[i]])[1], " x ", dim(Vec[[i]])[2],

" (defined for ", dstr[i], ")"

)

}Let us first set up the set of international trade flows matrix, \(X_{ij}\) (w/ \(i\) exporting to \(j\)). This is just the set of flows arranged in an exporter (rows) by importer (columns) fashion.

X <- flows

n <- sqrt(length(X)) # Length of row or column of trade matrix

X <- t(matrix(flows, n, n)) # Square the matrix

printHead(X)

#> [,1] [,2] [,3] [,4] [,5]

#> [1,] 7.047775e+05 61.95446 345.4675 5.71090 5.577426e+02

#> [2,] 3.658264e+02 261390.90409 1224.3476 144.50709 2.635246e+02

#> [3,] 4.753819e+02 1516.67071 343253.2434 68.76933 4.872147e+02

#> [4,] 7.448854e-01 17.67560 111.4472 25137.17943 1.040889e+00

#> [5,] 4.858000e+02 221.86748 1308.2011 47.55200 1.086039e+06

#> [6,] 1.437038e+03 659.92572 1136.6122 7.58329 8.533425e+02

#> [,6]

#> [1,] 1.583679e+03

#> [2,] 8.459328e+02

#> [3,] 6.059549e+02

#> [4,] 1.269456e+01

#> [5,] 8.835362e+02

#> [6,] 1.066313e+06Then, set \({\texttt B} \ (= e^{\beta})\) to be the matrix of partial effects. Notice that the diagonal must be set to 0.

B <- beta

dim(B) <- c(n, n) # Format B to have K.n columns

diag(B) <- 0 # Set diagonal to 0 (this is required and is corrected if found)

B <- exp(B)

printHead(B)

#> [,1] [,2] [,3] [,4] [,5] [,6]

#> [1,] 1 1.000000 1.000000 1.000000 1 1

#> [2,] 1 1.000000 1.000000 1.251383 1 1

#> [3,] 1 1.000000 1.000000 1.251383 1 1

#> [4,] 1 1.251383 1.251383 1.000000 1 1

#> [5,] 1 1.000000 1.000000 1.000000 1 1

#> [6,] 1 1.000000 1.000000 1.000000 1 1Now, we can set up some more variables:

Let \(E_j\) be the Total National Expendatures for country \(j\) such that \(E_j \equiv \sum_i X_{ij}\).

Let \(Y_j\) be the Total Labor Income for country \(i\) such that \(Y_i \equiv w_iL_j = \sum_j X_{ij}\).

Let \(D_j\) be the National Trade Deficit for country \(j\) such that \(D_j \equiv E_j - Yj\).

# Set up Y, E, D vectors; calculate trade balances

E <- matrix(colSums(X), n, 1) # Total National Expendatures; Value of import for all origin

Y <- matrix(rowSums(X), n, 1) # Total Labor Income; Value of exports for all destinations;

D <- E - Y # D: National trade deficit / surplus

sanity(c("E","Y","D"), list(E, Y, D), c("j","j","j"))

#> > Sanity Check:

#> - dim(E) = 44 x 1 (defined for j)

#> - dim(Y) = 44 x 1 (defined for j)

#> - dim(D) = 44 x 1 (defined for j)Then we set up the \(\pi_{ij}\) matrix of bilateral trade shares such that \(\pi_{ij} = X_{ij}/E_{j}\):

# set up pi_ij matrix of trade shares; pi_ij = X_ij/E_j

Pi <- X / kronecker(t(E), matrix(1,n,1)) # Bilateral trade share

sanity(c("X"), list(X), c("i and j"))

#> > Sanity Check:

#> - dim(X) = 44 x 44 (defined for i and j)Now, we are almost done. In this model, we want to build up:

The change in price levels in each country \(\hat{P_j}\) for all exporters.

The change in welfare \(\hat{W}_{j}\) for all exporters.

The general equilibrium trade impact (GETI) \(\hat{X}_{ij}\) between all exporters and importers.

The iterative algorithm provided will build these up iteratively, starting them off as 1-column matrices.

w_hat <- P_hat <- matrix(1, n, 1) # Containers for running w_hat and P_hat

X_new <- X # Container for updated X

sanity(c("w_hat", "P_hat"), list(w_hat, P_hat), c("i", "i"))

#> > Sanity Check:

#> - dim(w_hat) = 44 x 1 (defined for i)

#> - dim(P_hat) = 44 x 1 (defined for i)Loop Processes

Step 1: Update \(\hat{w}_i\) for all origins using formula:

\[\widehat{w}_{i} =\left[Y_{i}^{-1}\sum_{j}\frac{\pi_{ij}\cdot e^{\beta\times FTA_{ij}}}{\widehat{P}_{j}^{-\theta}}\cdot E_{j}^{\prime}\right]^{\frac{1}{1+\theta}}\quad\forall i.\]

Step 2: Normalize so total world output stays the same:

\(\sum_{i}Y_{i}\widehat{w}_{i}=\sum_{i}Y_{i}\).

Step 3: Update

\(\widehat{P}_{j}^{-\theta}=\left[\sum_{k}\pi_{kj}\widehat{w}_{k}^{-\theta}e^{b\times FTA_{kj}}\right] \forall \ j\).

Calculate new trade shares (to verify convergence)

p1 <- (Pi * B)

p2 <- kronecker((w_hat^(-theta)), matrix(1,1,n))

p3 <- kronecker(t(P_hat), matrix(1,n,1))

Pi_new <- ts(Pi, p1 * p2 / p3, 296)

X_new <- ts(X, Pi_new * kronecker(t(E), matrix(1,n,1)))From there, we just need a way to check convergence to a steady-state, so let’s put it all together:

# Initialize w_i_hat = P_j_hat = 1

w_hat <- P_hat <- matrix(1, n, 1) # Wi = Ei/Pi

# While Loop Initializations

X_new <- X # Container for updated X

crit <- 1 # Convergence testing value

curr_iter <- 0 # Current number of iterations

max_iter <- 1000000 # Maximum number of iterations

tol <- .00000001 # Threshold before sufficient convergence

# B = i x j

# D = 1 x j

# E = 1 x j

# w_hat = P_hat = i x 1

# Y = E = D = i x 1

repeat { # Event Loop (using repeat to simulate do-while)

X_last_step <- X_new

#### Step 1: Update w_hat_i for all origins:

eqn_base <- ((Pi * B) %*% (E / P_hat)) / Y

w_hat <- eqn_base^(1/(1+theta))

#### Step 2: Normalize so total world output stays the same

w_hat <- w_hat * (sum(Y) / sum(Y*w_hat))

#### Step 3: update P_hat_j

P_hat <- (t(Pi) * t(B)) %*% (w_hat^(-theta))

#### Step 4: Update $E_j$

if (mult) {

E <- (Y + D) * w_hat

} else {

E <- Y * w_hat + D # default is to have additive trade imbalances

}

#### Calculate new trade shares (to verify convergence)

p1 <- (Pi * B)

p2 <- kronecker((w_hat^(-theta)), matrix(1,1,n))

p3 <- kronecker(t(P_hat), matrix(1,n,1))

Pi_new <- p1 * p2 / p3

X_new <- t(Pi_new * kronecker(t(E), matrix(1,n,1)))

# Compute difference to see if data converged

crit = max(c(abs(log(X_new) - log(X_last_step))), na.rm = TRUE)

curr_iter <- curr_iter + 1

if(crit <= tol || curr_iter >= max_iter)

break

}From here, we can just aggregate statistics, based in part with the formulas:

\[ \begin{alignat}{1} \textbf{GE Welfare Impact}:\quad & \widehat{W}_{i}=\widehat{E}_{i}/\widehat{P}_{i}\\ \\ \textbf{GE Real Wage Impact}:\quad & \widehat{rw}_{ij}=\widehat{w}_{i}/\widehat{P}_{i},\\ \textbf{GE Trade Impact}:\quad & \widehat{X}_{ij}=\frac{\widehat{w}_{i}^{-\theta}e^{\beta\times FTA_{ij}}}{\widehat{P}_{j}^{-\theta}}\cdot\widehat{E}_{j} \end{alignat} \]

# Post welfare effects and new trade values

dim(X_new) <- c(n*n, 1)

# Real wage impact

real_wage <- w_hat / (P_hat)^(-1/theta)

# real_wage <- (diag(Pi_new) / diag(Pi))^(-1/theta) # (ACR formula)

# Welfare impact

if (mult) {

welfare <- real_wage

} else {

welfare <- ((Y * w_hat) + D) / (Y+D) / (P_hat)^(-1/theta)

}

# Kronecker w/ this creates n dupes per dataset in column to align with X matrix

kron_base <- matrix(1, n, 1)

welfare <- kronecker(welfare, kron_base)

real_wage <- kronecker(real_wage, kron_base)

nom_wage <- kronecker(w_hat, kron_base)

price_index <- kronecker(((P_hat)^(-1/theta)), kron_base)And then, we can just return them:

# Build and return the final list

data_out <- ge_baseline_data

data_out$new_trade <- X_new

data_out$welfare <- welfare

data_out$real_wage <- real_wage

data_out$nom_wage <- nom_wage

data_out$price_index <- price_index

head(data_out[,c(1:2,5:6,12:16)])

#> exporter importer year trade new_trade welfare real_wage

#> 1 AUS AUS 2000 704777.47410 7.047388e+05 0.9999938 0.9999945

#> 5 AUS AUT 2000 61.95446 6.200899e+01 0.9999938 0.9999945

#> 9 AUS BEL 2000 345.46746 3.454304e+02 0.9999938 0.9999945

#> 13 AUS BGR 2000 5.71090 5.302484e+00 0.9999938 0.9999945

#> 17 AUS BRA 2000 557.74257 5.576790e+02 0.9999938 0.9999945

#> 21 AUS CAN 2000 1583.67895 1.583680e+03 0.9999938 0.9999945

#> nom_wage price_index

#> 1 0.9999236 0.9999292

#> 5 0.9999236 0.9999292

#> 9 0.9999236 0.9999292

#> 13 0.9999236 0.9999292

#> 17 0.9999236 0.9999292

#> 21 0.9999236 0.9999292Running The Algorithm

Pre-Processing

# Foreign trade subset

f_trade <- TradeData0014[TradeData0014$exporter != TradeData0014$importer,]

# Normalize trade data to unit interval

f_trade$trade <- f_trade$trade / max(f_trade$trade)

# classify FEs for components to be absorbed (finding variable interactions)

f_trade$exp_year <- interaction(f_trade$expcode, f_trade$year)

f_trade$imp_year <- interaction(f_trade$impcode, f_trade$year)

f_trade$pair <- interaction(f_trade$impcode, f_trade$expcode)

# Fit generalized linear model based on specifications

partials <- feglm(

formula = trade ~ eu_enlargement + other_fta | exp_year + imp_year + pair,

data = f_trade,

family = poisson()

)$coefficient # We just need the coefficients for computation

# Sort trade matrix to make it easier to find imp/exp pairs

t_trade <- TradeData0014[order(

TradeData0014$exporter,

TradeData0014$importer,

TradeData0014$year

),]

t_trade$eu_effect <- NA # this creates a new column with the partial effect of EU membership for new EU pairs

i <- 1

# Effect of EU entrance on country based on partial, if entry happened

invisible(by(t_trade, list(t_trade$expcode, t_trade$impcode), function(row) {

# Was a new EU pair created within time span?

t_trade[i:(i+nrow(row)-1), "eu_effect"] <<- diff(row$eu_enlargement, lag=nrow(row)-1)

i <<- i + nrow(row)

}))

# If added to EU, give it the computed partial eu_enlargement coefficient as the effect

t_trade$eu_effect = t_trade$eu_effect * partials[1]

# Data to be finally fed to the function

data <- t_trade[t_trade$year == 2000,] # In example, 1892 Entries, 5676 removed

head(data)

#> exporter importer expcode impcode year trade eu_enlargement other_fta

#> 1 AUS AUS 1 1 2000 704777.47410 0 1

#> 5 AUS AUT 1 2 2000 61.95446 0 0

#> 9 AUS BEL 1 3 2000 345.46746 0 0

#> 13 AUS BGR 1 4 2000 5.71090 0 0

#> 17 AUS BRA 1 5 2000 557.74257 0 0

#> 21 AUS CAN 1 6 2000 1583.67895 0 0

#> FTA pair eu_effect

#> 1 1 1.1 0

#> 5 0 1.2 0

#> 9 0 1.3 0

#> 13 0 1.4 0

#> 17 0 1.5 0

#> 21 0 1.6 0Running Actual Computations

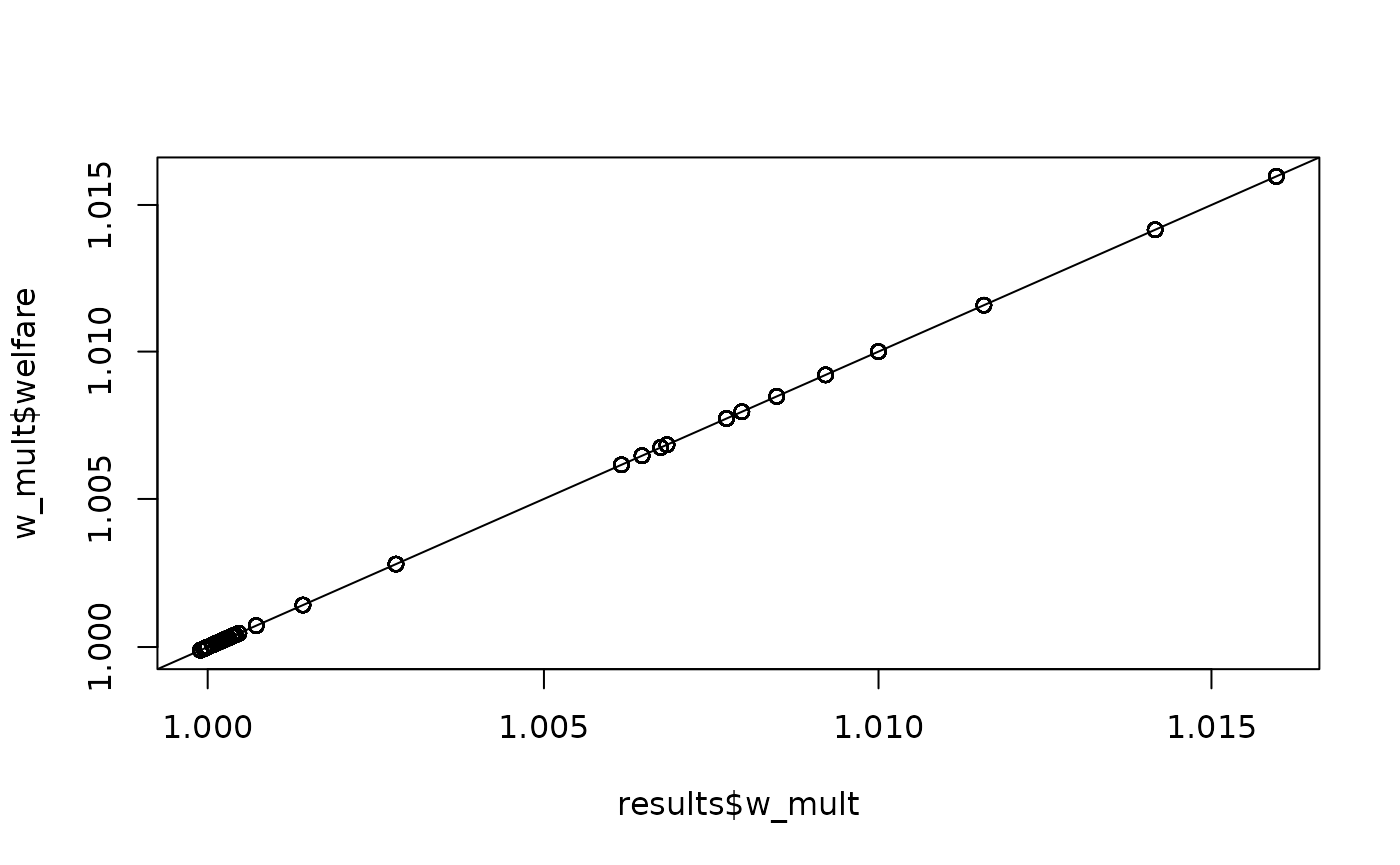

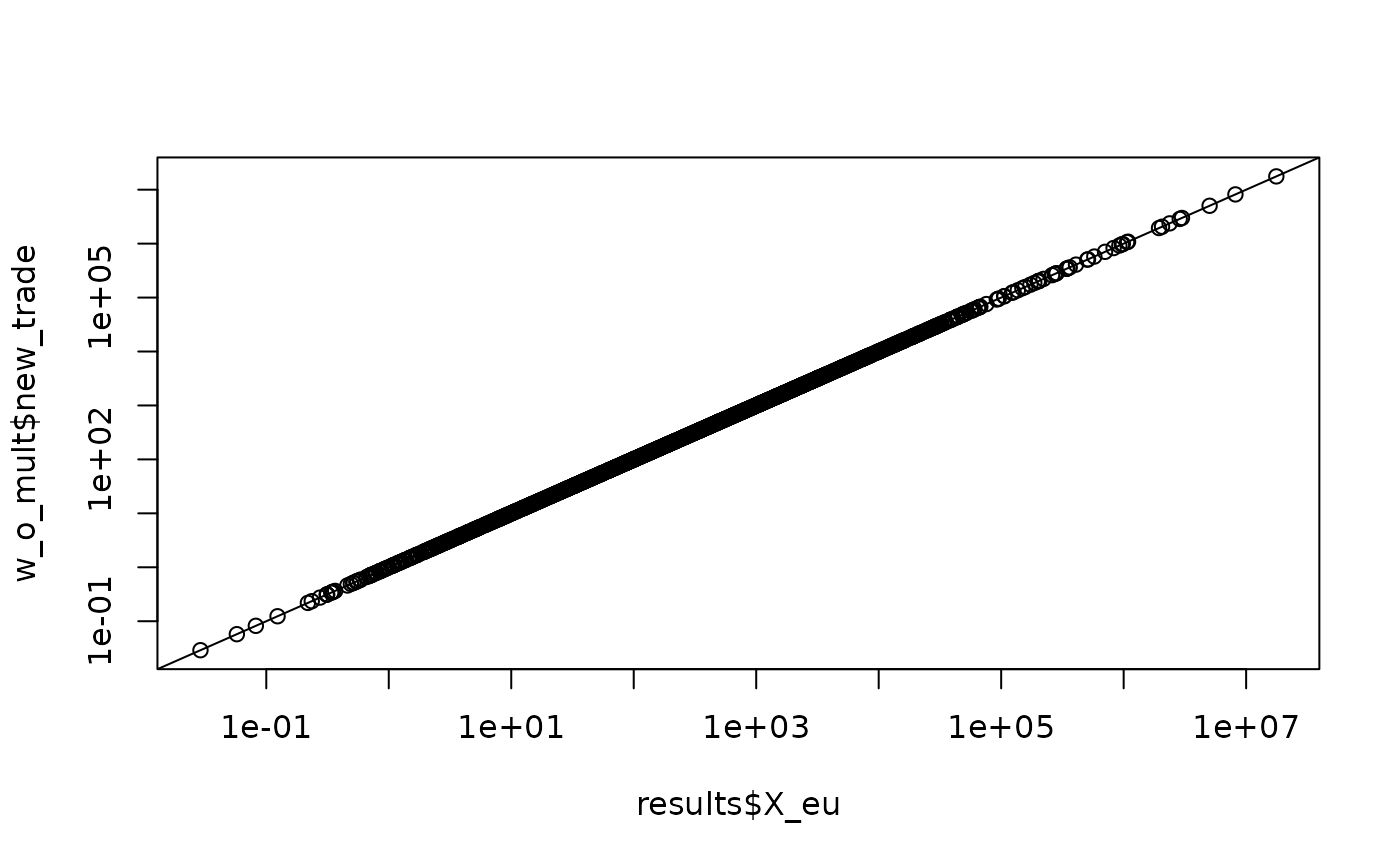

## Difference between w_mult and w_o_mult is how trade balance is considered

## mult = TRUE assumes multiplicative trade balances; false assumes additive

w_mult <- ge_gravity(

exp_id = data$expcode, # Origin country associated with each observation

imp_id = data$impcode, # Destination country associated with each observation

flows = data$trade, # Observed trade flows in the data for the year being used as the baseline

beta = data$eu_effect, # “Partial” change in trade, obtained as coefficient from gravity estimation

theta = 4, # Trade elasticity

mult = TRUE, # Assume trade balance is a multiplicative component of national expenditure

data = data

)

w_o_mult <- ge_gravity(

exp_id = data$expcode, # Origin country associated with each observation

imp_id = data$impcode, # Destination country associated with each observation

flows = data$trade, # Observed trade flows in the data for the year being used as the baseline

beta = data$eu_effect, # “Partial” change in trade, obtained as coefficient from gravity estimation

theta = 4, # Trade elasticity

mult = FALSE, # Assume trade balance is an additive component of national expenditure

data = data

)Final results without multiplication parameter

head(w_o_mult)

#> exporter importer expcode impcode year trade eu_enlargement other_fta

#> 1 AUS AUS 1 1 2000 704777.47410 0 1

#> 5 AUS AUT 1 2 2000 61.95446 0 0

#> 9 AUS BEL 1 3 2000 345.46746 0 0

#> 13 AUS BGR 1 4 2000 5.71090 0 0

#> 17 AUS BRA 1 5 2000 557.74257 0 0

#> 21 AUS CAN 1 6 2000 1583.67895 0 0

#> FTA pair eu_effect new_trade welfare real_wage nom_wage price_index

#> 1 1 1.1 0 7.047388e+05 0.9999938 0.9999945 0.9999236 0.9999292

#> 5 0 1.2 0 6.200899e+01 0.9999938 0.9999945 0.9999236 0.9999292

#> 9 0 1.3 0 3.454304e+02 0.9999938 0.9999945 0.9999236 0.9999292

#> 13 0 1.4 0 5.302484e+00 0.9999938 0.9999945 0.9999236 0.9999292

#> 17 0 1.5 0 5.576790e+02 0.9999938 0.9999945 0.9999236 0.9999292

#> 21 0 1.6 0 1.583680e+03 0.9999938 0.9999945 0.9999236 0.9999292Final results with multiplication parameter

head(w_mult)

#> exporter importer expcode impcode year trade eu_enlargement other_fta

#> 1 AUS AUS 1 1 2000 704777.47410 0 1

#> 5 AUS AUT 1 2 2000 61.95446 0 0

#> 9 AUS BEL 1 3 2000 345.46746 0 0

#> 13 AUS BGR 1 4 2000 5.71090 0 0

#> 17 AUS BRA 1 5 2000 557.74257 0 0

#> 21 AUS CAN 1 6 2000 1583.67895 0 0

#> FTA pair eu_effect new_trade welfare real_wage nom_wage price_index

#> 1 1 1.1 0 7.047407e+05 0.9999948 0.9999948 0.9999268 0.9999321

#> 5 0 1.2 0 6.200460e+01 0.9999948 0.9999948 0.9999268 0.9999321

#> 9 0 1.3 0 3.454142e+02 0.9999948 0.9999948 0.9999268 0.9999321

#> 13 0 1.4 0 5.261708e+00 0.9999948 0.9999948 0.9999268 0.9999321

#> 17 0 1.5 0 5.576743e+02 0.9999948 0.9999948 0.9999268 0.9999321

#> 21 0 1.6 0 1.583683e+03 0.9999948 0.9999948 0.9999268 0.9999321Comparison with Stata Counterpart

Before running comparisons, we need to slightly modify the results data to sync with our new format.

# Notice that the Stata counterpart returned all years with a sparse

# selection labeled with computed values. Ours just returns the new data

# by default or tags it onto the data provided in the `data` parameter.

# To make it sync, just extract a year.

results <- TradeData0014_Results[TradeData0014_Results$year == 2000, ]

head(results)

#> exporter importer expcode impcode year trade eu_enlargement other_fta

#> 1 AUS AUS 1 1 2000 704777.47410 0 1

#> 5 AUS AUT 1 2 2000 61.95446 0 0

#> 9 AUS BEL 1 3 2000 345.46746 0 0

#> 13 AUS BGR 1 4 2000 5.71090 0 0

#> 17 AUS BRA 1 5 2000 557.74257 0 0

#> 21 AUS CAN 1 6 2000 1583.67895 0 0

#> FTA new_eu_pair eu_effect w_eu X_eu w_mult X_mult

#> 1 1 0 0 0.9999938 7.047388e+05 0.9999948 7.047407e+05

#> 5 0 0 0 0.9999938 6.200899e+01 0.9999948 6.200460e+01

#> 9 0 0 0 0.9999938 3.454304e+02 0.9999948 3.454142e+02

#> 13 0 0 0 0.9999938 5.302484e+00 0.9999948 5.261708e+00

#> 17 0 0 0 0.9999938 5.576790e+02 0.9999948 5.576743e+02

#> 21 0 0 0 0.9999938 1.583680e+03 0.9999948 1.583683e+03Advisory

This is an advanced technique that requires a basic understanding of the model being solved. I would recommend reading either Section 4.3 of Head & Mayer (2014) or Ch. 2 of Yotov, Piermartini, Monteiro, & Larch (2016) before implementing.

One common issue that researchers new to these methods should be

aware of is that GE trade models require a “square” data set with

information on internal trade flows in addition to data on international

trade flows. In the model, these internal flows are denoted by \(X_{ii}\). If ge_gravity

detects that the variable given for does not include one or more \(X_{ii}\) terms, it will exit with an error.

Not all publicly available trade data sets include internal trade

values. But some that do include WIOD, Eora MRIO, and the data set made

available by UNCTAD

as part of their online course on trade policy analysis (see Yotov,

Piermartini, Monteiro, & Larch, 2016.)

Depending on interest, future versions could feature additional

options such as allowances for tariff revenues and/or multiple sectors.

If you believe you have found an error that can be replicated, or have

other suggestions for improvements, please feel free to

contact me.

Acknowledgements

The basic idea of using fixed point iteration to solve the gravity model has previously been implemented in Stata by Head & Mayer (2014) and Anderson, Larch, & Yotov (2015). Funding for this R package was provided by the Department for Digital, Culture, Media and Sport, United Kingdom.

Suggested citation

If you are using this command in your research, please cite

- Baier, Scott L., Yoto V. Yotov, and Thomas Zylkin. “On the widely differing effects of free trade agreements: Lessons from twenty years of trade integration”. Journal of International Economics 116 (2019): 206-226.

The algorithm used in this command was specifically written for the exercises performed in this paper. Section 6 of the paper provides a more detailed description of the underlying model and its connection to the literature.

Further Reading

- Structural gravity: Anderson & van Wincoop (2003); Head & Mayer (2014)

- Methods for solving trade models: Alvarez & Lucas (2007); Anderson, Larch, & Yotov (2015); Head & Mayer (2014)

- Hat algebra: Dekle, Eaton, & Kortum (2007)

- GE effects of EU enlargements: Felbermayr, Gröschl, & Heiland (2018); Mayer, Vicard, & Zignago (2018).